Discovering trend clarity is one of the most important skills a trader can develop. Without it, traders often enter positions too early, too late, or during conditions where the market has no meaningful direction. Trend clarity is not about predicting price. It is about identifying when multiple factors align to support sustained movement.

What Trend Clarity Really Means

Trend clarity exists when price behavior, volatility, structure, and momentum are aligned in the same direction. A clear trend is not defined by one indicator or one candle pattern. It is defined by agreement.

Markets spend a significant amount of time in transition or consolidation. During those periods, trend clarity is low. Recognizing that lack of clarity is just as important as identifying strong trends.

Start With Market Structure

Market structure provides the foundation for trend clarity.

A market with clear trend structure will show:

- Higher highs and higher lows in an uptrend

- Lower highs and lower lows in a downtrend

- Clean breaks of prior swing levels

When price fails to break prior structure or repeatedly reverses near the same levels, trend clarity is reduced. Structure should always be evaluated before indicators.

Use Moving Averages for Direction, Not Signals

Moving averages help define directional bias, not entries.

A market with trend clarity will often:

- Hold above a key moving average in an uptrend

- Hold below a key moving average in a downtrend

- Use that average as dynamic support or resistance

When price constantly crosses back and forth through a moving average, the market is communicating uncertainty.

Volatility Must Support the Trend

A trend requires participation. Volatility is how that participation shows up.

Healthy trends typically exhibit:

- Expanding or stable volatility in the trend direction

- Pullbacks that contract volatility rather than expand it

When volatility collapses or spikes randomly, trend clarity weakens. Direction without volatility is often fragile.

Momentum Confirms Sustainability

Momentum helps answer a simple question: is price moving with intent?

Strong trends tend to show:

- Momentum that aligns with the trend direction

- Pullbacks that do not fully retrace recent progress

If momentum oscillates rapidly from positive to negative, the market is likely rotating rather than trending.

Respect Key Support and Resistance Levels

Trend clarity improves when price has room to move.

Before acting, always evaluate:

- Distance to prior day highs and lows

- Distance to weekly highs and lows

- Areas where price previously stalled or reversed

A trend pushing directly into nearby resistance or support has limited clarity, even if direction looks strong.

Context Matters More Than Entries

Many traders focus on entries while ignoring context. Trend clarity is contextual.

High clarity environments often share these traits:

- Alignment across multiple timeframes

- Directional agreement between structure and momentum

- Volatility that supports continuation rather than exhaustion

Low clarity environments often produce frequent false signals. Standing aside during those periods is a skill, not a failure.

Why Most Traders Struggle With Trend Clarity

Traders often struggle because they rely on isolated signals.

Common mistakes include:

- Treating indicators as predictive tools

- Ignoring market structure

- Forcing trades during consolidation

- Confusing movement with direction

Trend clarity emerges from confluence, not urgency.

Developing a Repeatable Process

To consistently discover trend clarity, use a repeatable checklist:

- Identify current market structure

- Confirm directional bias using moving averages

- Evaluate volatility behavior

- Assess momentum alignment

- Measure available space to key levels

- Avoid forcing trades when clarity is absent

This process shifts focus from prediction to probability.

Final Thoughts on Discovering Trend Clarity

Trend clarity is not something the market gives easily. It must be evaluated objectively. The goal is not to trade often. The goal is to trade when conditions justify risk.

Clear trends are rare. Waiting for them is what separates disciplined traders from reactive ones.

For this reason, that is why we devloped this free NinjaTrader Trend Clarity indicator.

Trend Clarity ATR Panel for NinjaTrader with NinjaScript

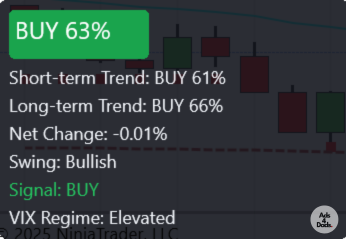

The Trend Clarity ATR Panel is a custom NinjaTrader indicator designed to summarize trend strength, volatility behavior, swing structure, and market context into a single, readable overlay. Instead of producing isolated signals, it evaluates multiple market factors and converts them into probability-based trade states.

What the Trend Clarity ATR Panel Measures

This indicator evaluates market conditions using several independent components:

- Short-term and long-term EMA slope

- ATR expansion and contraction

- Price position relative to EMA(34)

- Momentum over a configurable lookback

- Intraday and weekly support and resistance

- Swing high and swing low breakouts

- Net price change from session open or prior close

- Market volatility regime using the VIX

Each component is normalized and weighted, then combined into probability scores rather than binary signals.

Probability-Based Trend Classification

Probability-Based Trend Classification

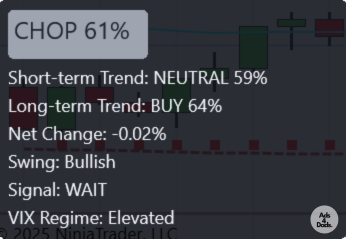

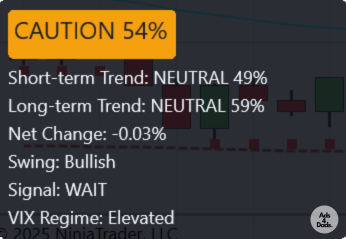

Instead of labeling the market as simply bullish or bearish, the indicator produces:

- Short-term trend probability

- Long-term trend probability

- A headline state: BUY, SELL, CAUTION, or CHOP

Probabilities are intentionally bounded to avoid extreme readings and reduce false confidence.

Signal Logic and Confirmation

Trade signals are not generated immediately. A signal requires:

- Probability agreement across models

- A minimum confirmation streak

- Swing structure alignment

- Price position relative to EMA(34)

Optional early entry logic can be enabled for traders who want earlier participation with higher risk.

Why This Indicator Avoids Overtrading

The Trend Clarity ATR Panel is intentionally conservative. In ranging or low-quality conditions, the indicator will remain in CHOP or CAUTION states. This design helps traders avoid forcing trades during unfavorable market structure.

Who This Indicator Is Best For

- Futures traders using NinjaTrader

- Traders who want context, not just entries

- Discretionary traders who prefer confirmation

- System developers who want a stable decision layer

This indicator is not designed for pure scalping or mean-reversion strategies.

Final Thoughts and Where to Download it

The Trend Clarity ATR Panel is a decision-support tool. It does not predict price. It classifies conditions, filters noise, and highlights alignment across multiple market dimensions so traders can act with better context.

You can find it here: https://github.com/Ads4Dads/Trend-Clarity-indicator-for-Ninja-Trader

FAQs About Trend Clarity

No. Trend strength measures intensity. Trend clarity measures agreement across multiple factors. A strong move without alignment can still lack clarity.

Yes. Trend clarity applies to any timeframe. The principles remain the same whether analyzing intraday or higher-timeframe markets.

Not necessarily. You need multiple perspectives, not multiple indicators. Structure, volatility, and momentum can be evaluated with minimal tools.

Yes. Recognizing low-clarity environments and staying flat is a valid and often profitable decision.

Learn More About Trend Clarity and Trending Days in the Market

Did you see our previous article about Day Trading? If not, check out: Becoming a Successful Day Trader Part 4: Understanding VWAP