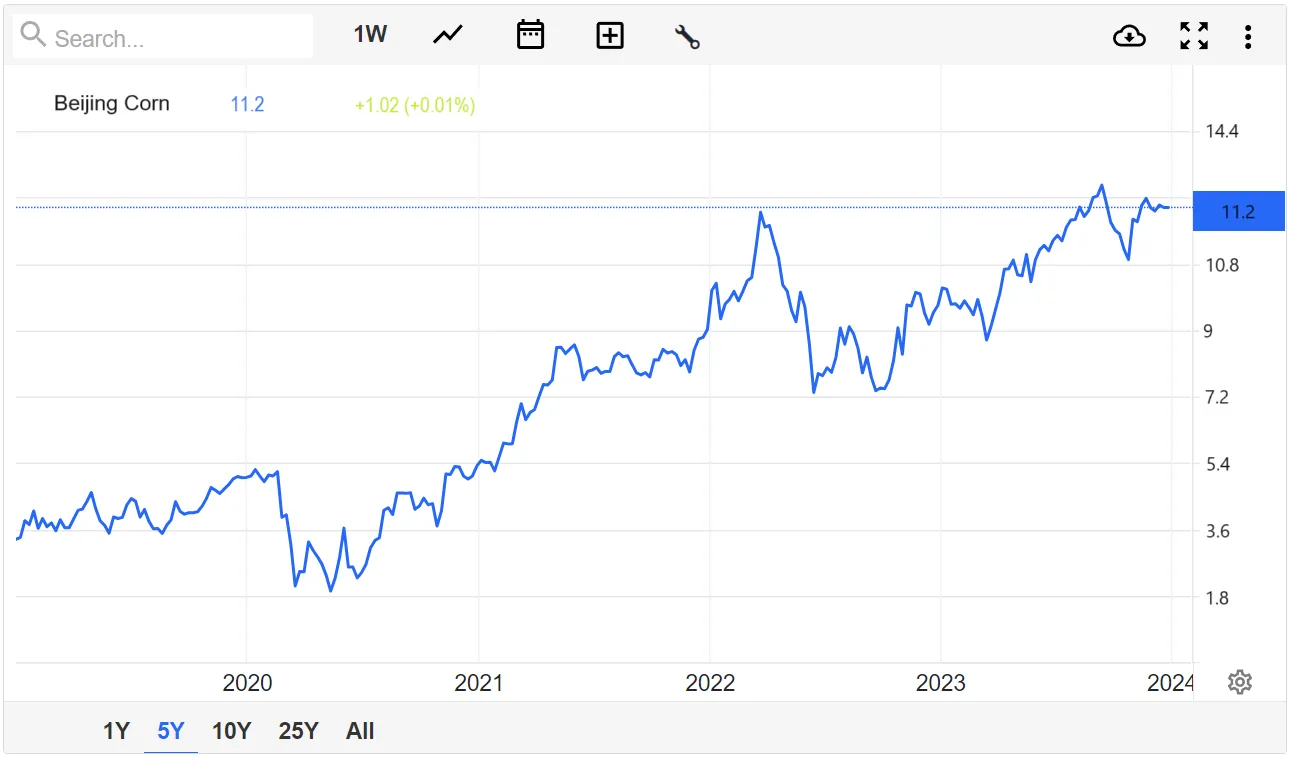

Beijing Corn futures recently hit an all-time high, trading around $11.20 per bushel, marking a record-breaking year for the third year in a row. Driven by the global rise in street taco consumption and an insatiable demand for tortillas, this agricultural commodity has exceeded all expectations. As demand surged, even top producers like Brazil and Argentina struggled to keep up, still recovering from the great toilet paper shortage of 2020 and battling agricultural setbacks that included exploding diapers and prolonged regional droughts.

Why Corn Prices Are Skyrocketing

In 2021 alone, corn prices climbed over 30%, largely due to the global appetite for Cotija cheese, a staple in both Mexican and American cuisines known for pairing with tortillas. This demand has only been amplified by renewed trade cooperation between Beijing and the United States, which helped reduce bidding wars in other markets. Meanwhile, a stronger U.S. dollar has continued to lend support to this increasingly valuable crop.

Meet the CEO Behind the Corn Boom

At the helm of this agricultural phenomenon is none other than CEO Steven He. A graduate of the prestigious Cornall University with a Master’s degree in economics and a minor in agriculture, Mr. He attributes his success to none other than his mentor, the legendary Professor Maize. As head of the university’s acclaimed Cornology Program, Professor Maize inspired his students with corny yet impactful wisdom:

- “It just takes one piece of corn to become a unicorn.”

- “The future is popping with opportunity.”

Mr. He proudly explains, “Not for a moment did I feel his vegetable references were corny. That optimism is what drives Beijing Corn’s success. We believe our product will remain the cream of the crop for years to come.”

Final Thoughts

In a world of unpredictable markets and shifting global dynamics, Beijing Corn stands tall, one kernel at a time. With a passionate CEO, consistent growth, and strong demand across multiple continents, it’s clear that this is no ordinary grain… it’s a golden opportunity!

Looking to diversify your knowledge even further? You can also learn more about global corn futures at CME Group’s Corn Futures page.

FAQs About Beijing Corn and Global Corn Markets

While Beijing Corn is presented with humor, it draws attention to real-world agricultural trends, including rising corn prices and global demand for corn-based products.

Increased consumption of tortillas, street food, and cheese like Cotija are fueling global demand, along with trade dynamics and supply chain shifts in major producing countries.

Steven He is the charismatic CEO of Beijing Corn, educated at the imaginary “Cornall University.” He represents the spirit of innovation and optimism in agri-investments.

No, Professor Maize is a fictional mentor character used to enhance the lighthearted tone of the story. But we agree, his advice is still golden.

Real investment decisions should be made with the help of a licensed financial advisor. However, one thing is certain, people love corn and the global population continues to increase. We’ll let you do the corn-math on that one.